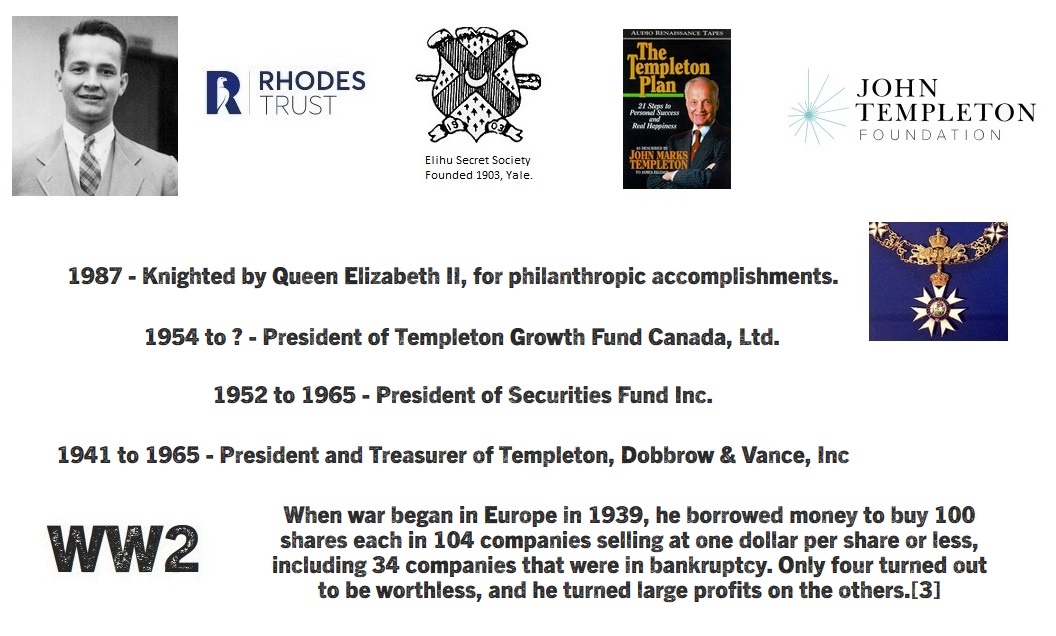

John Marks Templeton (Rhodes 1934, Elihu)

Finance. Yale University. Elihu Secret Society. Rhodes Scholar, University of Oxford.

2010, Published - Buying at the Point of Maximum Pessimism: Six Value Investing Trends from China to Oil to Agriculture.

2007, Published - Investing the Templeton Way: The Market Beating Strateagies of Value Investings Legendary Bargain Hunter.

2006, Published - Riches for the Mind and Spirit: John Marks Templeton’s Treasury of Words to Help, Inspire, and Live By.

1999, Money magazine called him “arguably the greatest global stock picker of the century.”.[3]

1998, Published - Worldwide Laws of Life: 200 Eternal Spiritual Principles.

1997, Published - Golden Nuggets from Sir John Templeton.

1994, Published - Discovering the Laws of Life.

1994, Published - Is God the Only Reality? Science Points to a Deeper Meaning of the Universe.

1992, Published - Templeton Plan: 21 Steps to Personal Success and Real Happiness.

1987 - Knighted by Queen Elizabeth II, for philanthropic accomplishments.[3]

1981, Published - The humble approach: Scientists discover God.

1972, he established the world’s largest annual award given to an individual, the Templeton Prize, which honors a living person who has made an exceptional contribution to affirming life’s spiritual dimension. Its monetary value, currently £1,000,000, always exceeds that of the Nobel Prizes, which was Templeton’s way of underscoring his belief that advances in the spiritual domain are no less important than those in other areas of human endeavor.[3]

1954 to ? - President of Templeton Growth Fund Canada, Ltd. With dividends reinvested, each $10,000 invested in the Templeton Growth Fund Class A at its inception would have grown to $2 million by 1992, when he sold the family of Templeton Funds to the Franklin Group.[3]

1952 to 1965 - President of Securities Fund Inc.

1941 to 1965 - President and Treasurer of Templeton, Dobbrow & Vance, Inc. [in New York City]

1939, When war began in Europe, he borrowed money to buy 100 shares each in 104 companies selling at one dollar per share or less, including 34 companies that were in bankruptcy. Only four turned out to be worthless, and he turned large profits on the others.[3]

1938, started his Wall Street career and and went on to create some of the world’s largest and most successful international investment funds. He took the strategy of “buy low, sell high” to an extreme, picking nations, industries, and companies hitting rock-bottom, what he called “points of maximum pessimism.”[3]

1934 to ? - Rhodes Scholar, BalliolCollege, University of Oxford.[1]

Graduated Yale University, Elihu Club.

Died 8 Jul 2008, from Not Known. Age 95.

[2] - FYI - Wiki -John Marks Templeton (Rhodes 1934, Elihu)

[3] - Templeton.org - Biogrpahy - John Marks Templeton (Rhodes 1934, Elihu)

Comments