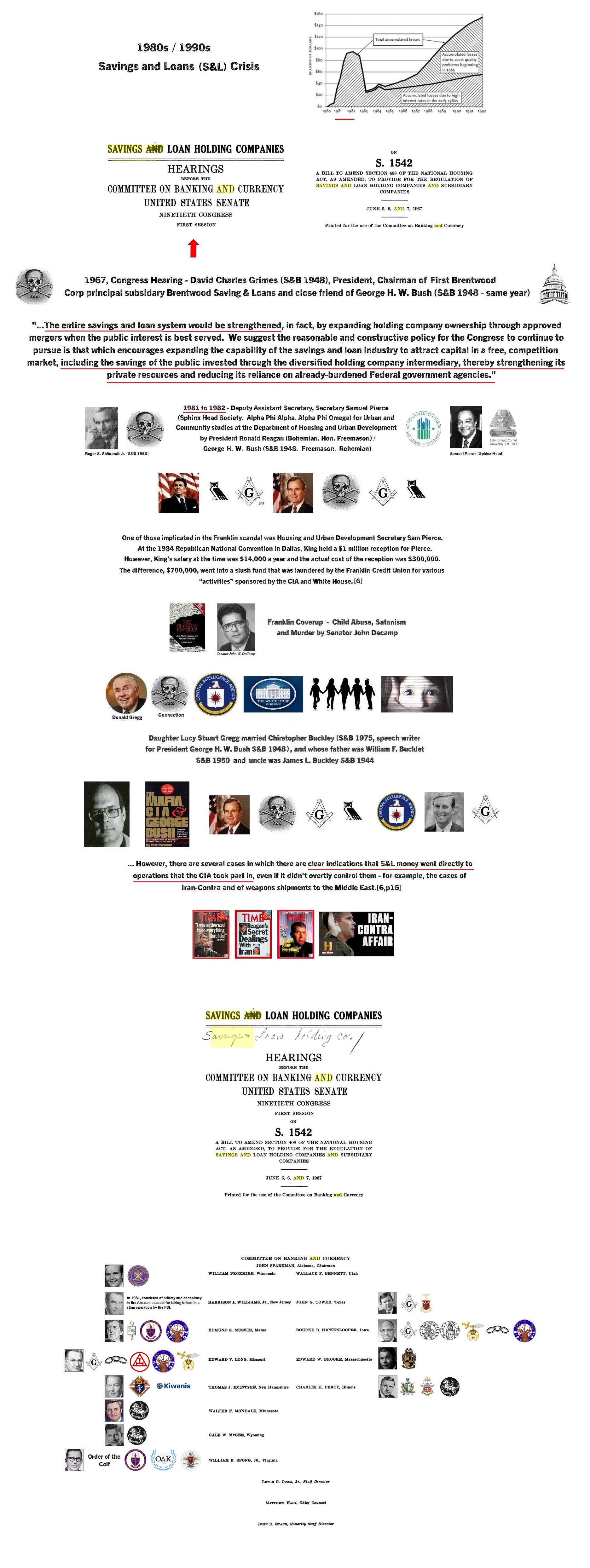

1980s / 1990s - Saving and Loan Crisis

Loans against assets (machinery, property etc) that did not exist.

Te Senate Ethics Committee investigated five U.S. Senators for improper conduct. The “Keating Five” included John McCarin (R-Ariz), Dennis DeConcini, D-Ariz, John Glenn, D-Ohio, Alan Cranston, D-Calif and Donald Riegle, D-Mich. Named after Charles Keating, head of Lincoln Savings and Loan Association. He had given them $1.5million total in campaign contributions. (No mention of the Bushes!)

1986 - Oil prices dropped, however historical accounting meant the original value of assets remained, making it seem that the banks were in better financial shape then they were.

1982 - President Reagan (Bohemian / Hon. Freemason) and Vice President George H. W. Bush (S&B1948. Freemason. Bohemian) signed the Garn-St. Germain Depository Institutions Act (Sponsored by Chairman of the Senate Banking Committee Jake Garn / Sigma Chi / NASA payload specialist). It completely eliminated the interest rate cap. It also permitted the banks to have up to 40 percent of their assets in commerical loans and 30 percent in consumer loans. In particular the law removed restrictions on loan-to-value ratios. It permitted the S&Ls to use federally-insured desposits to make risky loans. At the same time, Reagan [Bohemian. Hon. Freemason] [and VP George H. W. Bush S&B 1948, Freemason and Bohemian] cut the budgets of the regulatory staff at the FHLBB. This impaired its ability to investigate bad loans. Banks were also using historical accounting. They only listed the original price of the real estate they bought. They only updated the price when they sold the asset.

1967 - David Charles Grimes (S&B 1948) (President, Chairman of First Brentwood Corp principal subsidary Brentwood Saving & Loans) - “… The entire savings and loan system would be strengthened, in fact, by expanding holding company ownership through approved mergers when the public interest is best served. We suggest the reasonable and constructive policy for the Congress to continue to pursue is that which encourages expanding the capability of the savings and loan industry to attract capital in a free, competition market, including the savings of the public invested through the diversified holding company intermediary, thereby strengthening its private resources and reducing its reliance on already-burdened Federal government agencies.**”

1934 - Congress created the FSLIC to insure the Saving and Loans (S&L) deposits.

Skull and Bones / Others / Related - to be completed

David Charles Grimes (S&B 1948) - 1967 - (President, Chairman of First Brentwood Corp principal subsidary Brentwood Saving & Loans) - “… The entire savings and loan system would be strengthened

Neil Mallon Bush (Son of George H. W. Bush S&B 1948. Named after Henry Neil Mallon S&B 1917)

1985 to 1988 - Member of the board of directors of Denver-based Silverado Saving and Loan, during the savings and loan crisis of the 1980’s. Settled civil action out of court.

FYI - Barry Seal / George W. Bush (S&B 1968) - FAA ownership records which was part of Barry Seal’s (Search mind map) smuggling fleet of aircraft, and which was supposedly caught on tape in the sting, led directly to some of the major perpetrators of the financial frauds of the 1980’s, Iran Contra (Search mind map … Barbara Honegger and Gary Webb) and the saving and loans scandal.[3]

[1] - Article - Econlib.org - Savings and Loan Crisis

[2] - Article / Research - Rationalrevolution.net - The Bush family and the S&L Scandal

[4] - Article - Two Financial Crises Compared: The Savings and Loan Debacle and the Mortgage Mess.

[5] - Article - THE SAVINGS DEBACLE: A SPECIAL REPORT: A Financial Disaster With Many Culprits.

[6] - The Mafia, CIA and George Bush by Pete Brewton

“Unknown to the American Public - were their symbiotic relationships to the Mafia and the CIA, and to the two most prominent, powerful politicians from Texas, President George Bush [S&B 1948. Freemason. Bohemian] and Senator Lloyd Bentsen (Freemason. Shriner).[p10]

This small cabal of Businessmen realized that the S&Ls were going the way of the dinosaurs. They recognized that S&Ls couldn’t survive under rapid inflation and high interest rates. So they decided to exploit the situation for their own purposes, with help from, and rewards for, the Mafia, the CIA and their favourite politicians. They probably figured that the insulation and protection these powerful institutions and individuals conferred upon them, in addition to all the endemic protectiosn within the financial, judicial, political and journalistic systems, made the invulnerable. There were probably right.

For unlike Watergate and Iran-Contra, this was a bipartisan scandal. There was no opposition party to push for an independent investigation. In fact, the same group of wealthy, powerful businesmen, centered in Houston, that encircled Republicans like George Bush [S&B 1948. Freemason. Bohemian] and James A. Baker III [Phi Delta Theta], also encircle Democrats like Jim Wright and Lloyd Bentsen (Freemason).

In the second half of this book, a number of examples will be detailed to show how this happened, and who got the money. For example, one later chapter deals with a $200 million, 21,000-acre land transaction in Florida in which much of the borrowed S&L money went to a paper company owned by the Du Pont Empire, one of the oldest, richest, most powerful bastions of wealth in this country.[12]

…However, there are several cases in which there are clear indications that S&L money went directly to operations that the CIA took part in, even if it didn’t overtly control them - for example, the cases of Iran-Contra and of weapons shipments to the Middle East.[6,p16]

[7] - The Franklin Coverup - Child Abuse, Satanism, and Murder in Nebraska by John DeCamp

Comments